Your Massachusetts agi worksheet 2017 images are available in this site. Massachusetts agi worksheet 2017 are a topic that is being searched for and liked by netizens today. You can Find and Download the Massachusetts agi worksheet 2017 files here. Find and Download all free images.

If you’re searching for massachusetts agi worksheet 2017 images information related to the massachusetts agi worksheet 2017 topic, you have visit the ideal blog. Our site frequently provides you with suggestions for seeing the maximum quality video and image content, please kindly search and locate more enlightening video articles and graphics that match your interests.

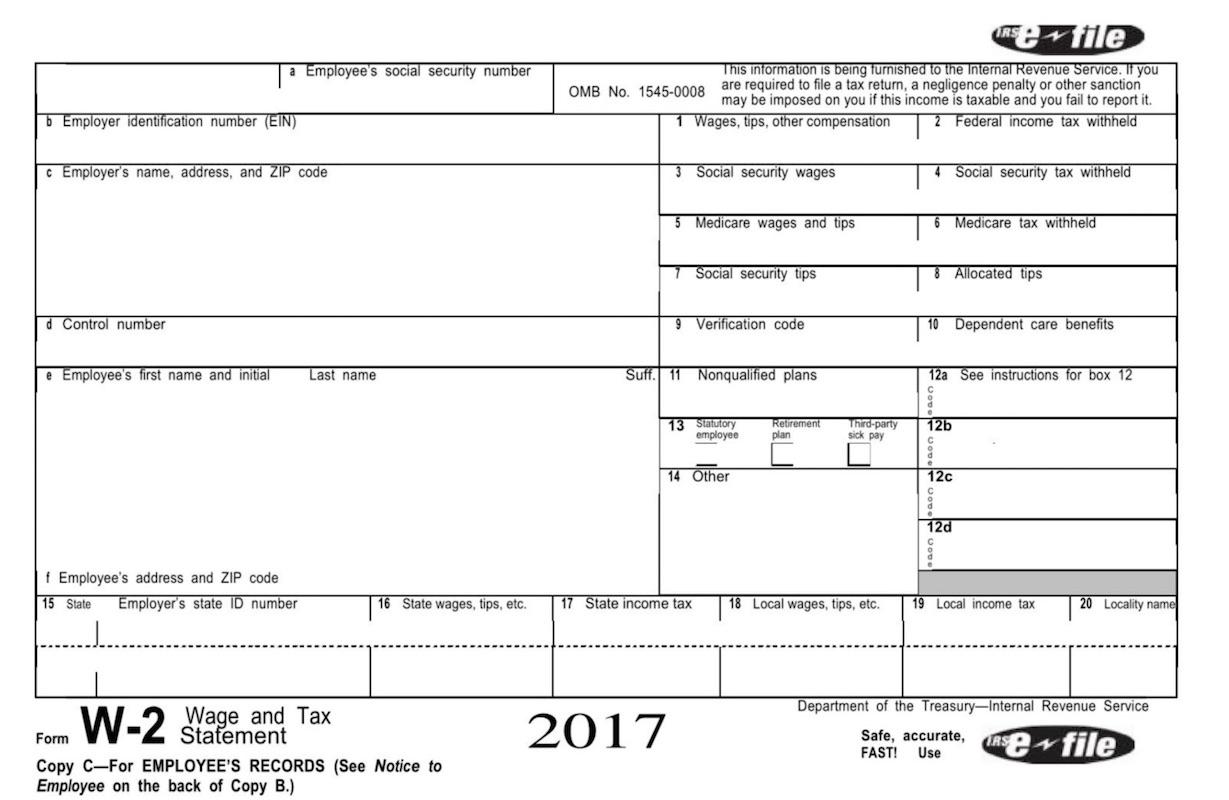

Massachusetts Agi Worksheet 2017. Compute the following integrals. Residents Complete the Massachusetts AGI Worksheet in the Form 1 instructions. Then select the option to print your 2017 federal and state returns. GO TO MASSGOVDOR FOR MORE INFORMATION.

How Does The New Tax Overhaul Affect You From aarp.org

How Does The New Tax Overhaul Affect You From aarp.org

Spring 2017 MA 114 Worksheet 02 Tuesday Jan. Here we translate the worksheet instructions into simple formulas using shorthand names for different kinds of adjustments that have to be added back to AGI to produce modified AGI. FILL OUT IN BLACK INK. This worksheet will determine the household rent payment based on the greatest of 10 of Monthly Gross Income or 30 of Monthly Adjusted Income. Department of Revenue Commonwealth of Massachusettsgov ile Before using paper consider Form 1 2017 Massachusetts Resident Income Tax Fast Filing electronically rather than on paper can mean much faster processing of your refund and money in your account sooner. The amount to be reported on this worksheet is for only those expenses that are directly related to taxable income reported on Form 1 NRPY.

If you qualify fill in the oval on Form 1 Line 27 and enter 0 on Line 28.

If you qualify fill in the oval on Form 1 Line 27 and enter 0 on Line 28. Adjusted Gross Taxable Income. Write out the general form for the partial fraction decomposition but do not determine the numerical value of the coe cients. If qualified enter the amount from Line 6 of the College Tuition Deduction Worksheet on Form 1 Schedule Y Line 11. Underpayment of Massachusetts Estimated Income Tax PDF 10395 KB Open PDF file 6623 KB for. MA adjusted gross income MA adjusted gross income.

Limited Income Credit LIC Fill out the Massachusetts AGI worksheet. Massachusetts Adjusted Gross Income. FILE YOUR RETURN ELEC TRONICALLY FOR A FASTER REFUND. Limited Income Credit LIC Fill out the Massachusetts AGI worksheet. In the left side panel select Tax Tools then select Print Center.

Source:

This scan will identify 2016 Massachusetts 1065 returns. Massachusetts adopts this change as massachusetts follows the current irc with respect to irc 529. Nonresidents and part-year residents must complete the Schedule Y Line 1 - Massachusetts Employee Business Expense Deduction Worksheet Form 1-NRPY Instructions. Adjusted Gross Taxable Income. Calculating Massachusetts AGI Form 1 Line 10 Schedule B Line 35 interest dividends and short-term capital gains Schedule D Line 19 long-term capital gains-Schedule Y Lines 2 - 10-Schedule B adjustments-Schedule D adjustments Massachusetts AGI.

Source: pinterest.com

Source: pinterest.com

Ad Download over 20000 K-8 worksheets covering math reading social studies and more. Here we translate the worksheet instructions into simple formulas using shorthand names for different kinds of adjustments that have to be added back to AGI to produce modified AGI. A 1 x2 3x 2 b x 1 x2 4x 4 c x x2 1x 1x 2 d 2x 5 x2 132x 1 2. L 2015296en 01000101 Xml. Adjusted Gross Taxable Income.

Source:

L 2015296en 01000101 Xml. If youre submitting documents with an abatement application Form ABT or amended tax return attach the Massachusetts AGI worksheet. If you file form 1040a your agi is the amount on line 20 of that form. 17 2016 MA 114 Worksheet 02. Federal Student Loan Deduction.

Source: in.pinterest.com

Source: in.pinterest.com

Here we translate the worksheet instructions into simple formulas using shorthand names for different kinds of adjustments that have to be added back to AGI to produce modified AGI. 16-5-2018 Massachusetts - Tuition and Fees Deduction. For income exclusions see CPD Notice 96-03. FILE YOUR RETURN ELEC TRONICALLY FOR A FASTER REFUND. Massachusetts adopts this change as massachusetts follows the current irc with respect to irc 529.

Source: mikesandrik.com

Source: mikesandrik.com

Federal Student Loan Deduction. Massachusetts Adjusted Gross Income. FILE YOUR RETURN ELEC TRONICALLY FOR A FASTER REFUND. Then select the option to print your 2017 federal and state returns. Underpayment of Massachusetts Estimated Income Tax PDF 10395 KB Open PDF file 6623 KB for.

Source: investopedia.com

Source: investopedia.com

Read and Download Massachusetts Agi Worksheet Free Ebooks in PDF format - COMPREHENSIVE TOXICOLOGY. Limited Income Credit LIC Fill out the Massachusetts AGI worksheet. State Income tax Where to go for Line 7 of the Massachusetts AGI Worksheet on Form 1 or line 10 of Schedule NTS-l-NRPY. Integration by Partial Fractions 1. Ad Download over 20000 K-8 worksheets covering math reading social studies and more.

Source: in.pinterest.com

Source: in.pinterest.com

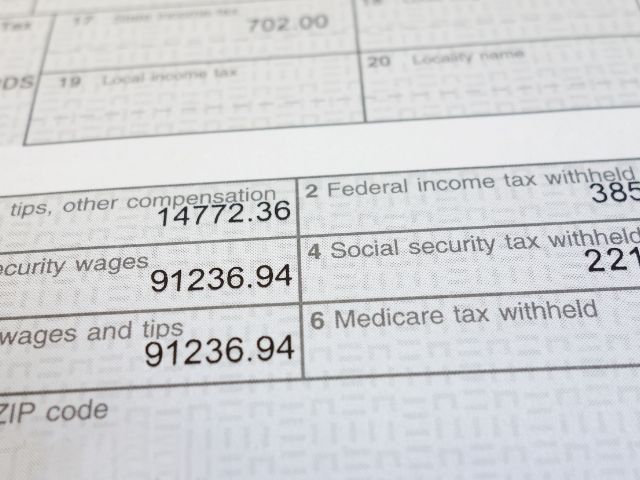

Massachusetts Adjusted Gross Income. Here we translate the worksheet instructions into simple formulas using shorthand names for different kinds of adjustments that have to be added back to AGI to produce modified AGI. Integration by Partial Fractions 1. Be sure to include state copy of Forms W-2 W-2G and 1099 showing Massachusetts withholding. Taxpayer fills out Massachusetts AGI Worksheet.

Source: youtube.com

Source: youtube.com

Discover learning games guided lessons and other interactive activities for children. Limited Income Credit LIC Fill out the Massachusetts AGI worksheet. SHP Regulation 24 CFR 583315 states Resident Rent. Less any grants scholarships and financial aid received exceed 25 of the Massachusetts AGI. If qualified enter the amount from Line 6 of the College Tuition Deduction Worksheet on Form 1 Schedule Y Line 11.

Source:

If you file form 1040a your agi is the amount on line 20 of that form. Department of Revenue Commonwealth of Massachusettsgov ile Before using paper consider Form 1 2017 Massachusetts Resident Income Tax Fast Filing electronically rather than on paper can mean much faster processing of your refund and money in your account sooner. SHP Regulation 24 CFR 583315 states Resident Rent. The maximum credit and the exclusion for employer-provided benefits are both 13570 per eligible child in 2017. Less any grants scholarships and financial aid received exceed 25 of the Massachusetts AGI.

Source: nl.pinterest.com

Source: nl.pinterest.com

FILL OUT IN BLACK INK. Less any grants scholarships and financial aid received exceed 25 of the Massachusetts AGI. A Z x 9. The maximum credit and the exclusion for employer-provided benefits are both 13570 per eligible child in 2017. This amount begins to phase out if you have modified adjusted gross income in excess of 203540 and is completely phased out for modified adjusted gross income of 243540 or more.

Source:

FILL OUT IN BLACK INK. Medical expenses irc 213. Underpayment of Massachusetts Estimated Income Tax PDF 10395 KB Open PDF file 6623 KB for. MA adjusted gross income MA adjusted gross income. Limited Income Credit LIC Fill out the Massachusetts AGI worksheet.

Source: pinterest.com

Source: pinterest.com

The Schedule Y Line 11 Worksheet - College Tuition Deduction Form 1 Instructions. Underpayment of Massachusetts Estimated Income Tax PDF 10395 KB Open PDF file 6623 KB for. Massachusetts adopts this change as massachusetts follows the current irc with respect to irc 529. As of tax year 2017 nonresidents and part-year residents are no longer eligible for this deduction. FILL OUT IN BLACK INK.

Source: yumpu.com

Source: yumpu.com

Residents Complete the Massachusetts AGI Worksheet in the Form 1 instructions. Taxpayer fills out Massachusetts AGI Worksheet. Calculating Massachusetts AGI Form 1 Line 10 Schedule B Line 35 interest dividends and short-term capital gains Schedule D Line 19 long-term capital gains-Schedule Y Lines 2 - 10-Schedule B adjustments-Schedule D adjustments Massachusetts AGI. Individual Income Tax Instructions Form 1 Instructions Department of Revenue Commonwealth of Massachusetts Form 1 2020 Massachusetts Resident Income Tax e l i F e v o g. L 2015296en 01000101 Xml.

Source: aarp.org

Source: aarp.org

Individual Income Tax Instructions Form 1 Instructions Department of Revenue Commonwealth of Massachusetts Form 1 2020 Massachusetts Resident Income Tax e l i F e v o g. Read and Download Massachusetts Agi Worksheet Free Ebooks in PDF format - COMPREHENSIVE TOXICOLOGY. Calculating Massachusetts AGI Form 1 Line 10 Schedule B Line 35 interest dividends and short-term capital gains Schedule D Line 19 long-term capital gains-Schedule Y Lines 2 - 10-Schedule B adjustments-Schedule D adjustments Massachusetts AGI. A Z x 9. Massachusetts Adjusted Gross Income.

Source: handytaxguy.com

Source: handytaxguy.com

A 1 x2 3x 2 b x 1 x2 4x 4 c x x2 1x 1x 2 d 2x 5 x2 132x 1 2. L 2015296en 01000101 Xml. Taxpayer fills out Massachusetts AGI Worksheet. Ad Download over 20000 K-8 worksheets covering math reading social studies and more. As of tax year 2017 nonresidents and part-year residents are no longer eligible for this deduction.

Source: investopedia.com

Source: investopedia.com

Ad Download over 20000 K-8 worksheets covering math reading social studies and more. Massachusetts adopts this change as massachusetts follows the current irc with respect to irc 529. Residents Complete the Massachusetts AGI Worksheet in the Form 1 instructions. This amount begins to phase out if you have modified adjusted gross income in excess of 203540 and is completely phased out for modified adjusted gross income of 243540 or more. A 1 x2 3x 2 b x 1 x2 4x 4 c x x2 1x 1x 2 d 2x 5 x2 132x 1 2.

Source: handytaxguy.com

Source: handytaxguy.com

Discover learning games guided lessons and other interactive activities for children. Taxpayer fills out Massachusetts AGI Worksheet. 16-5-2018 Massachusetts - Tuition and Fees Deduction. Next select Print save or preview this years return. Massachusetts adopts this change as massachusetts follows the current irc with respect to irc 529.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title massachusetts agi worksheet 2017 by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.